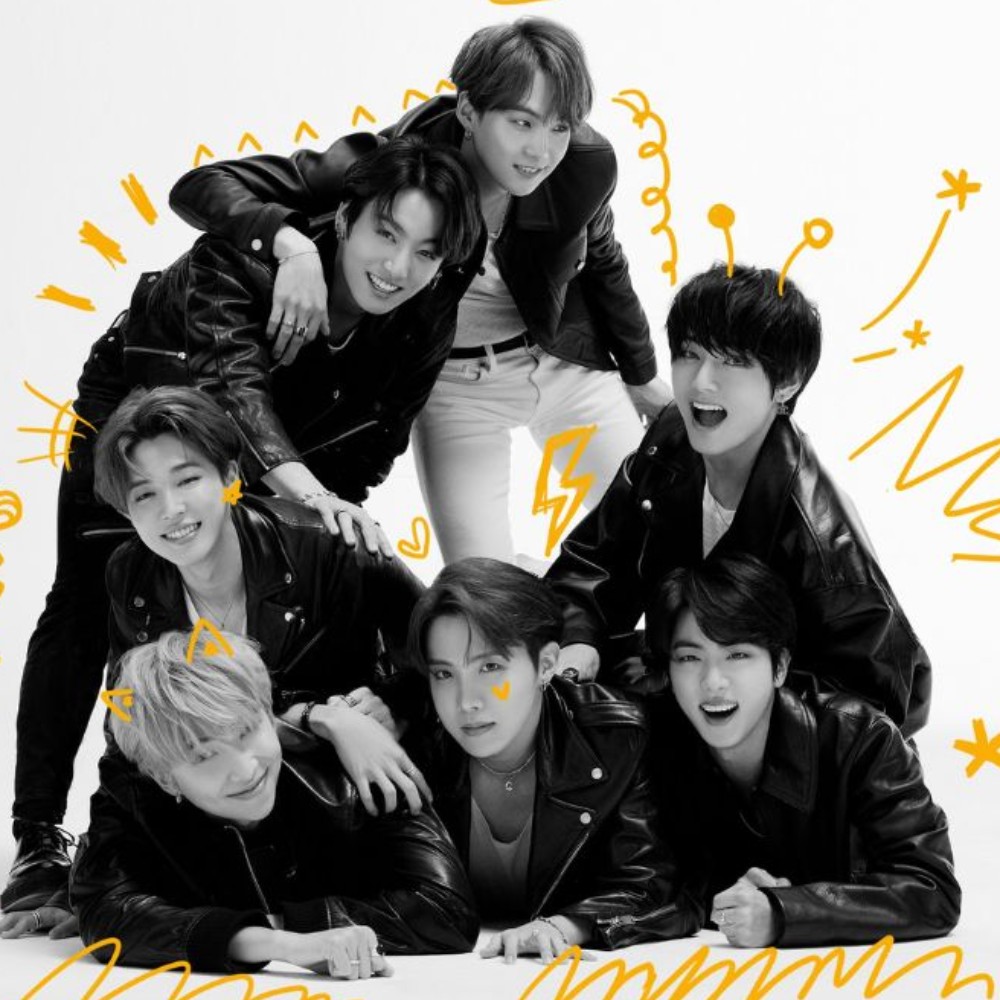

BTS Magic: HYBE reigns supreme as stocks reach 52-week high ahead of group's June reunion and J-Hope's solo tour

HYBE’s stock hits a 52-week high as anticipation for BTS’s full-group return drives momentum. J-Hope’s solo tour and potential Hallyu policy changes add to investor confidence.

HYBE Corporation continues to experience a strong upward trend in its stock performance, reaching a 52-week high as investors rally behind the expected return of global sensation BTS. On February 12, HYBE’s stock was trading at 250,000 KRW, marking a 1.83% increase (4,500 KRW) from the previous trading session. The stock’s steady climb underscores growing confidence in the company’s future growth, largely fueled by the imminent full-group reunion of BTS.

The main driving force behind HYBE’s stock surge is the growing anticipation surrounding BTS’ long-awaited full-group comeback. With Jin and J-Hope having already completed their mandatory military service, the remaining members are set to return in the coming months. RM and V are scheduled for discharge on June 10, followed by Jimin and Jungkook on June 11. Meanwhile, Suga, who has been serving as a public service worker, will complete his service on June 22.

The excitement around BTS’ return is expected to drive substantial business growth for HYBE. Analysts predict a resurgence in album sales, global tours, merchandise, and brand endorsements, reinforcing HYBE’s dominance in the entertainment industry. Given BTS’ history of breaking records and setting new benchmarks in the music industry, their return is poised to impact the company’s revenue streams and stock valuation.

In addition to the collective BTS comeback, J-Hope is set to begin his first solo world tour, further boosting HYBE’s market performance. His tour will kick off with three highly anticipated concerts at KSPO DOME in Seoul from February 28 to March 2. From there, he will perform in Brooklyn, Chicago, Mexico City, Manila, Saitama, Singapore, Jakarta, Bangkok, Macau, Taipei, and Osaka, covering a total of 31 shows across 15 cities.

Despite ongoing concerns over potential economic policy shifts, including speculation about tariff policies linked to the former U.S. President Donald Trump, entertainment stocks have largely remained stable. Another key factor driving optimism is the potential easing of China’s Hallyu (K-pop) restrictions. If the ban is lifted from South Korean entertainment content, HYBE and other major K-pop agencies could benefit from a major revenue boost through concert tours, endorsements, and content distribution in one of the world’s largest entertainment markets.

While BTS remains the primary catalyst for HYBE’s success, the company’s diverse artist lineup continues to strengthen its global position. Groups like SEVENTEEN, TXT, LE SSERAFIM, TWS, and BOYNEXTDOOR are expanding their international reach, securing lucrative brand deals, and holding sold-out tours worldwide. Investors continue to show confidence in the company’s ability to capitalize on its artists’ global influence, ensuring its stock remains on a strong upward trajectory.

ALSO READ: BTS’ Jungkook sets new Spotify record: SEVEN becomes fastest Asian song to hit 2.2 billion streams

JOIN OUR WHATSAPP CHANNEL

JOIN OUR WHATSAPP CHANNEL