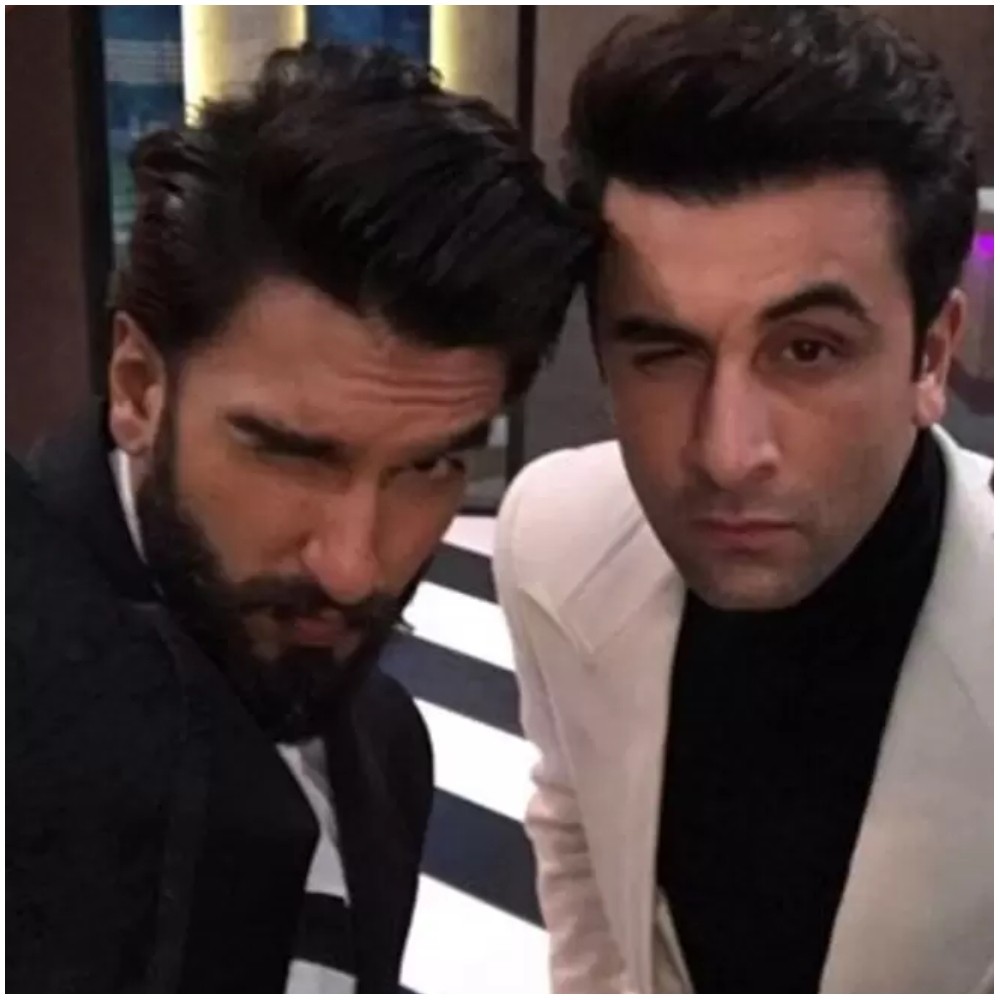

Mirroring The Industry: Satellite and digital deals, risk free business model & death of content in Bollywood

Has Bollywood started playing too safe and lost the ability of taking risks due to the lucrative digital and satellite deals from leading players? Pinkvilla Debates.

You give in your best when there is a lot at stake – we have often heard this saying in all spectrums of life. But what happens when there’s nothing at stake? The answer is simple, one tends to go complacent and churn out substandard products in the name of content. This is exactly what is happening with the Hindi film industry, popularly known as Bollywood across the globe. Over the last 10 years, the big wigs of the industry have established a risk-free model of filmmaking, meaning, the producer and the actor will never lose money on a project and it’s always going to be the third party that will entail losses.

Films in today’s time are conceived as business preposition – with budget being allotted based on backward calculation of what the film might fetch from the pre-selling satellite, digital, music and ancillary rights. The digital platforms opening up and trying to capture the Indian market has resulted in them splurging more than usual money to acquire films, which in turn has upped the revenue cycle for the producers. However, in most cases, the increased revenue is not being used to up the scale and budget of the film, instead, the producers use it as a medium to increase their table profit.

Over the last 10 years, the big wigs of the industry have established a risk-free model of filmmaking, meaning, the producer and the actor will never lose money on a project

Himesh Mankad

Projects in today’s world are being approved based on the “risk” and “revenue” factor, without taking into account the merit of the script. The easy revenue model has led to producers greenlighting mediocre projects as there are multiple buyers in the market as an insurance for their investment. It’s impossible for a producer to make losses today, if a film with superstar is made under the 100-crore production cost, as there are standing offers to acquire satellite, digital and music rights at astronomical prices. If there lies a sure shot business model to make profit, the producer would of course ignore what fate does the film face from the audience. Filmmaking is a business, sure and everyone wants to make profits. But should it be at the cost of content? Shouldn’t it be more like a culmination of art with commerce.

There is a multiple film deal on the verge of being cracked in the industry, wherein the star takes home all of satellite and digital rights revenue as his remuneration, and the producer would make a profit, even before a film goes on floors – reason? He is planning to tie up with a studio for a theatrical deal based on name of the star. And script? Well, the scripts will be locked or rather “found” once the deal is locked, as the revenue will then start flowing in. And budget? Well, of course, they will be allotted from the left over after money only after the remuneration of the star as also the profit of the producer is taken into account. It’s a sure shot model wherein both the producer and actor will make money, however, there is no insurance for the stakeholders who get hold of satellite, digital and theatrical rights as one doesn’t have a script in place.

There’s another producer, who is on the verge of starting a film with a star. And guess what? Both him and the star working on the film have filled their pockets with an aggregate profit of over 100 crore already. Content? Who cares. Basically, all the stakeholders except the satellite, digital and theatrical partners are in profit even before a single take. The external parties in today’s time are acquiring projects based on face value and the names involved, but there will come a point when the window dressed scenario will be busted, and the satellite and digital value of all the films will go down.

There is a multiple film deal on the verge of being cracked in the industry, wherein the star takes home all of satellite and digital rights revenue as his remuneration, and the producer would make a profit

Himesh Mankad

These pre-release deals have taken a toll not just on the risk-taking ability of producers and superstars, but it has also created a scenario wherein the audience is being taken for a ride with below par content. The day the risk factor comes into play, more time will be invested in the stories and the “chalta hai” or “chal jayega” attitude will be taking a back seat. Today, a Brahmastra is being made with utmost passion by all the stakeholders – from actors to producers and of course, the director, giving in 100% because there lies a risk of loss. There are delays, but it’s a passion project where one can’t afford to take a wrong step. There’s a fear and hence, the dedication. There are pre-release deals for Brahmastra too, but the imagination and vision is such that the deals are not enough to recover the money invested, and it’s the content that will help them sail through.

All films can’t be Brahmastra, but well, the fear of losing money will certainly push the industry to churn out better content in all genres. How about digital and satellite players signing the deals based on merit of the script rather than just going by the face value? Would that result in betterment of the entire industry? Wouldn’t it be a win and win scenario for everyone, with the audience and third party getting good content and the primary stakeholders elevating their goodwill by churning out respectable products. It’s a vice that the entire industry and almost all top guns are hit by, and it’s time to do the financials based on merit of the script rather than the value from the digital satellite world. Remember, sky is the limit for the theatrical revenue, when superstars associate themselves with good scripts. And that would be a lot more than the bare minimum insurance that satellite and digital deals provide. It about time, this happens.

Mirroring The Industry: How far are we from transparency of digital viewership data?

JOIN OUR WHATSAPP CHANNEL

JOIN OUR WHATSAPP CHANNEL