Rupert Grint Hit With $2.3M Tax Bill Over Harry Potter Residuals In New Ruling

Rupert Grint has been ordered to pay £1.8 million ($2.3 million) in taxes after a U.K. court ruled that his residual earnings from the franchise are taxable income rather than capital assets.

-

Rupert Grint must pay £1.8 million ($2.3 million) in taxes after a U.K. court decision

-

HMRC argued that Rupert Grint attempted a tax strategy similar to one used by the Beatles

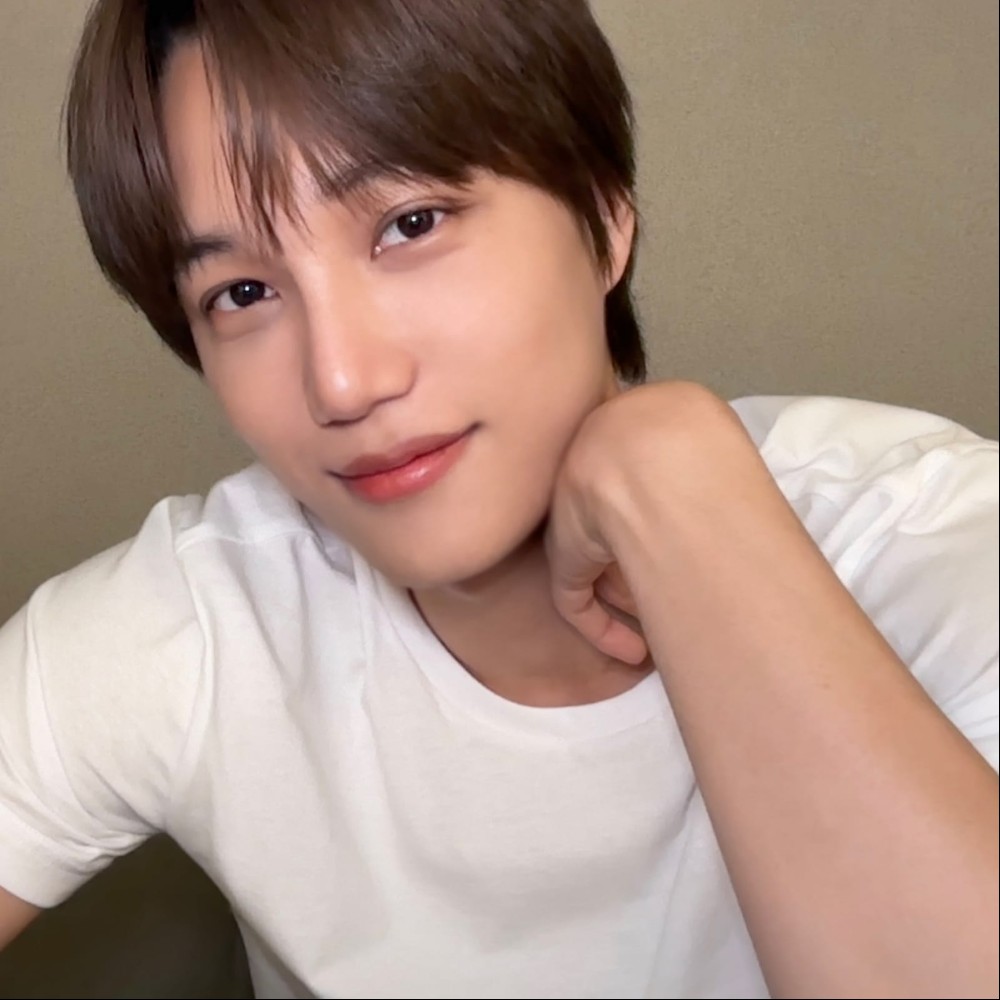

Rupert Grint, best known for playing Ron Weasley in the Harry Potter series, has been ordered to pay £1.8 million ($2.3 million) in taxes to the U.K.'s HMRC (His Majesty's Revenue and Customs). The tax ruling stems from Grint's earnings from Harry Potter residuals, which were recently classified as income rather than capital assets.

The decision follows a legal dispute that began in 2019. Grint’s representatives are yet to comment on the ruling, according to Entertainment Weekly.

The HMRC claimed Grint used a tax strategy similar to one the Beatles attempted in the 1960s. The so-called Beatles clause refers to a loophole where earnings are reclassified as capital gains to reduce tax liabilities.

Grint set up a company called Clay 10 Limited in 2011, selling his residual rights from Harry Potter to the company and reporting the earnings as capital assets.

Clay 10 Limited, which reportedly held more than £27 million ($34 million) in equity as of March 2023, was central to the case. However, Judge Harriet Morgan ruled that Grint’s residuals, largely from DVD and TV sales of the Harry Potter films, constituted taxable income, not capital gains.

During the case, Grint argued that he was not heavily involved in managing his finances. He placed his trust in his father and professional accountants to handle his financial affairs.

Judge Morgan acknowledged this in her ruling, stating that Grint "placed his faith in his father and accountants." Despite this, the court upheld HMRC's assessment of the taxes owed.

This isn't the first time Grint’s Harry Potter earnings have drawn scrutiny. In 2019, the HMRC initially flagged the actor for incorrectly classifying £4.5 million in residuals as capital assets. Grint's legal team appealed, but the latest ruling leaves him with a significant tax bill.

Grint, who made his screen debut in 2001’s Harry Potter and the Sorcerer’s Stone, earned approximately £27 million during his time in the franchise, according to the Associated Press. While co-stars Daniel Radcliffe and Emma Watson have pursued high-profile projects, Grint has kept a lower profile.

Recently, he has appeared in M. Night Shyamalan’s Knock at the Cabin, the Apple TV+ series Servant, and Guillermo del Toro’s Cabinet of Curiosities. Despite his quieter career, Grint remains a household name thanks to the enduring popularity of the Harry Potter franchise.

JOIN OUR WHATSAPP CHANNEL

JOIN OUR WHATSAPP CHANNEL