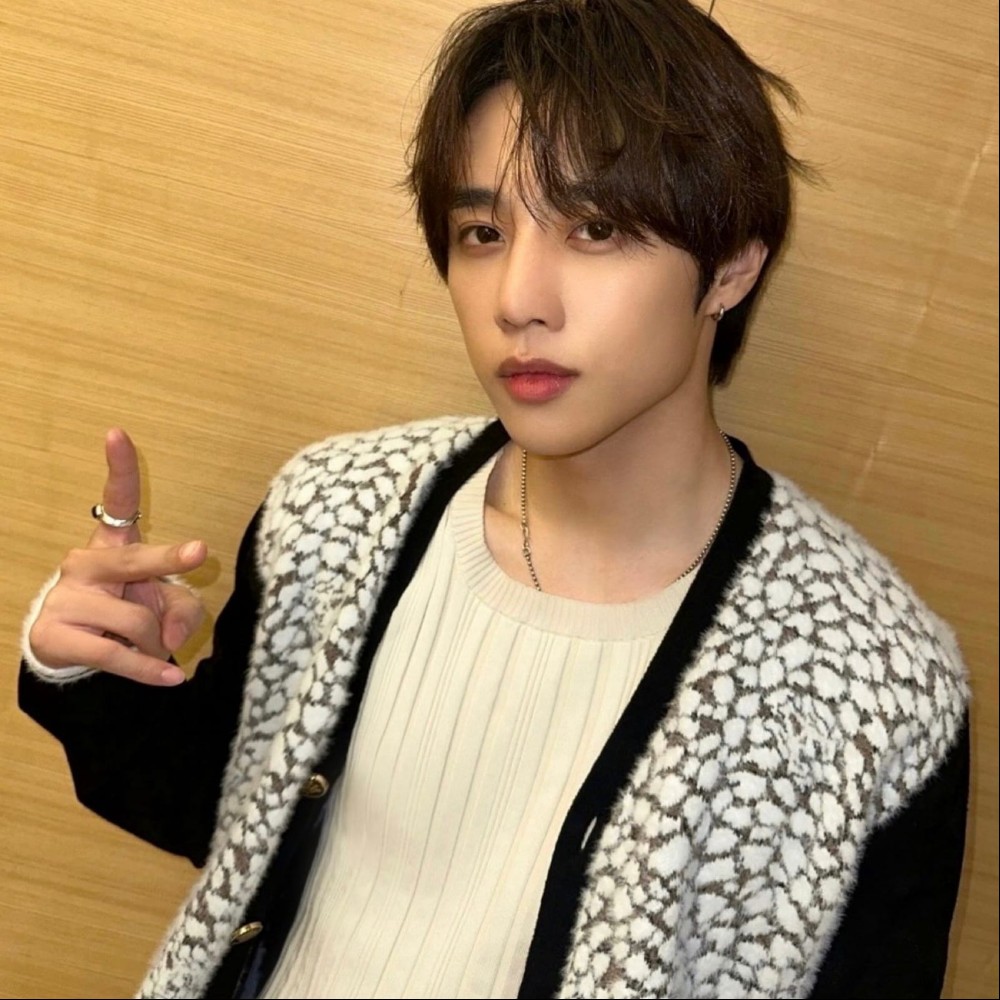

Lee Joon Gi asked to pay 900 million KRW after Yoo Yeon Seok's 7 billion and Jun Ji Hyun's 20 million tax bills; here's why

Lee Joon Gi faces tax evasion accusations, following similar allegations against Yoo Yeon Seok and Jun Ji Hyun. Read more details inside!

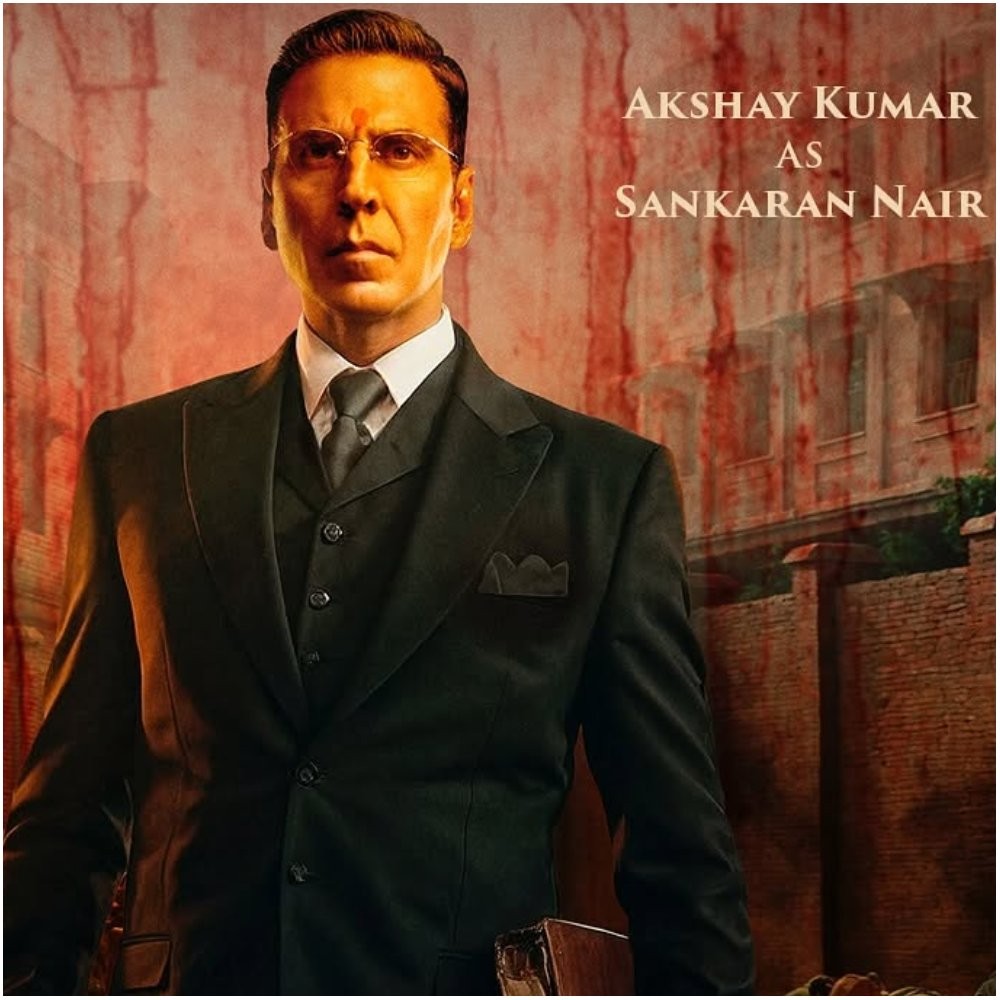

Flower of Evil fame Lee Joon Gi was reportedly under investigation regarding possible tax evasion. As per a March 19 report of K-media Chosun Biz, the Gangnam Tax Office in Seoul initiated a tax audit against the actor and his agency Namoo Actors in 2023. After about two years of investigation, the National Tax Service (NTS) imposed taxes worth 900 million KRW, revealed his agency. They also presented their response to the same, in an attempt to keep things transparent with the actor's fans.

Regarding the payment of the additional tax, Namoo Actors' stated, "He (Lee Joon Gi) respected the tax authorities' decision and paid the assessed amount in full." They also revealed their following stance: challenging the NTS' decision through legal means. As per them, the additional tax situation arose from differences in the calculation of the company's tax accountant and the investigative authorities. The agency mentioned NTS' access of 900 KRW (approximately 620,000 USD) being based on the actor's "previous tax practices."

As per Namoo Actors, "there are conflicting opinions among tax experts and academics regarding its implications." According to them, the points of contention between the two parties center around two key issues: whether "the transaction of tax invoices between our agency and JG Entertainment established by actor Lee Joon Gi was appropriate" and if the "tax on this income should be considered corporate tax for JG Entertainment or personal income tax for actor Lee Joon Gi."

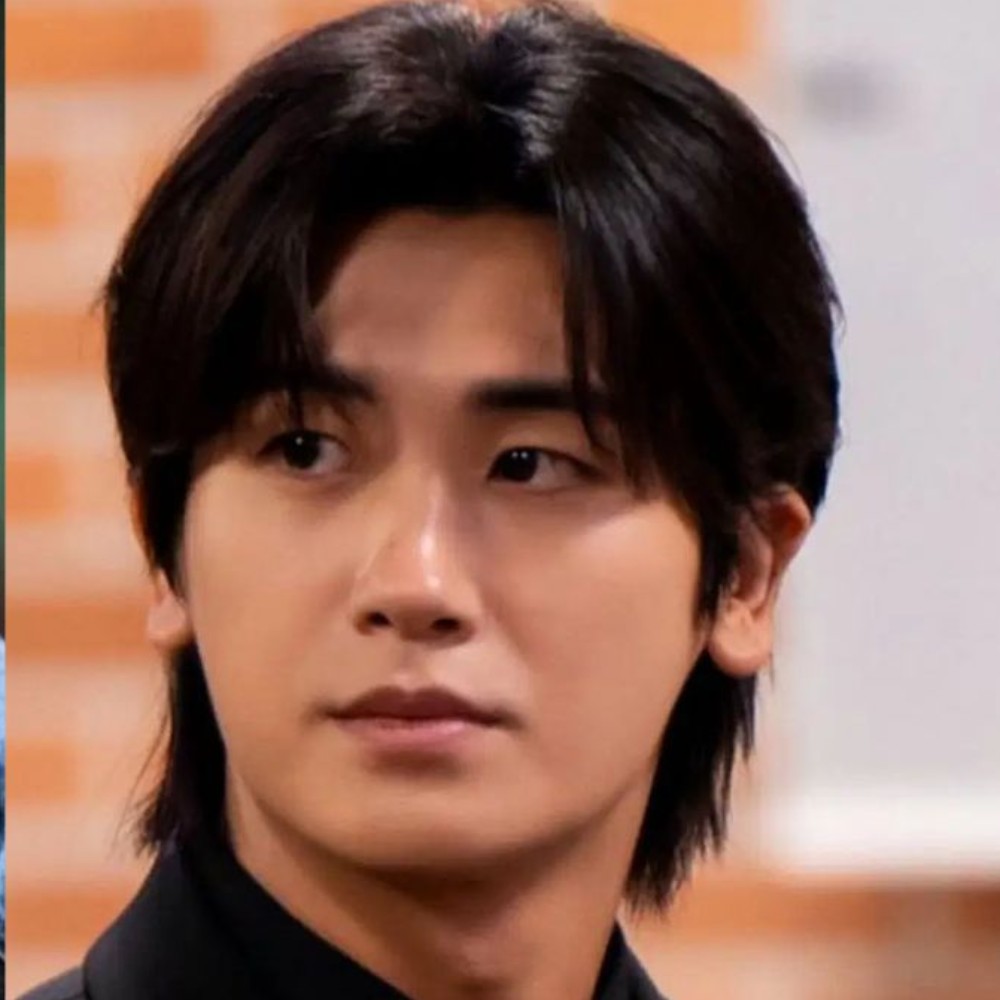

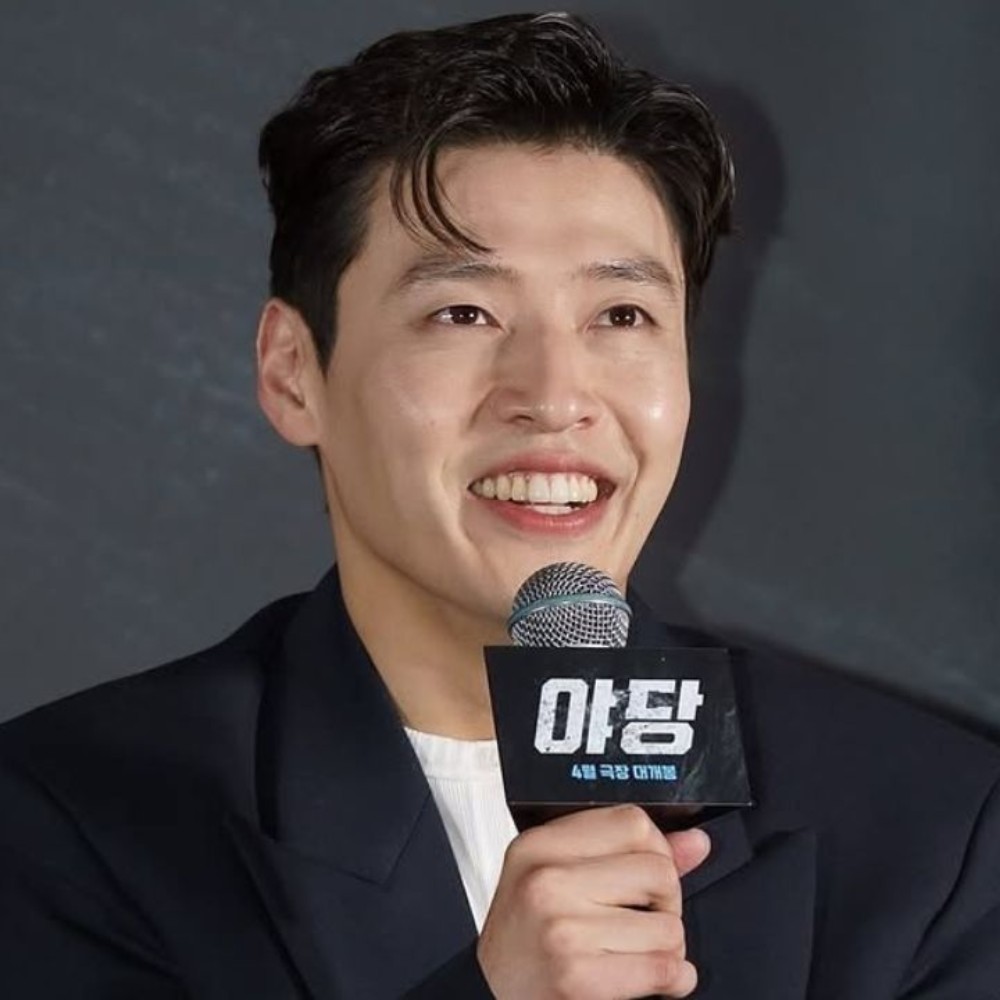

Lee Joon Gi's tax reassessment news comes after similar controversies surrounding popular actors Yoo Yeon Seok and Jun Ji Hyun. Yoo Yeon Seok was recently hit with a substantial 7 billion KRW tax penalty, which is the biggest amount of tax evasion levied against a South Korean celebrity as of yet. Jun Ji Hyun faced a 20 million KRW tax bill and her agency mentioned the case's non-relation to any legal trouble.

Notably, both of them, like Lee Joong Gi, have contested the authorities' decisions and presented similar reasons of a difference in calculation method of their tax accountants and NTS as the root cause of the issue.

JOIN OUR WHATSAPP CHANNEL

JOIN OUR WHATSAPP CHANNEL