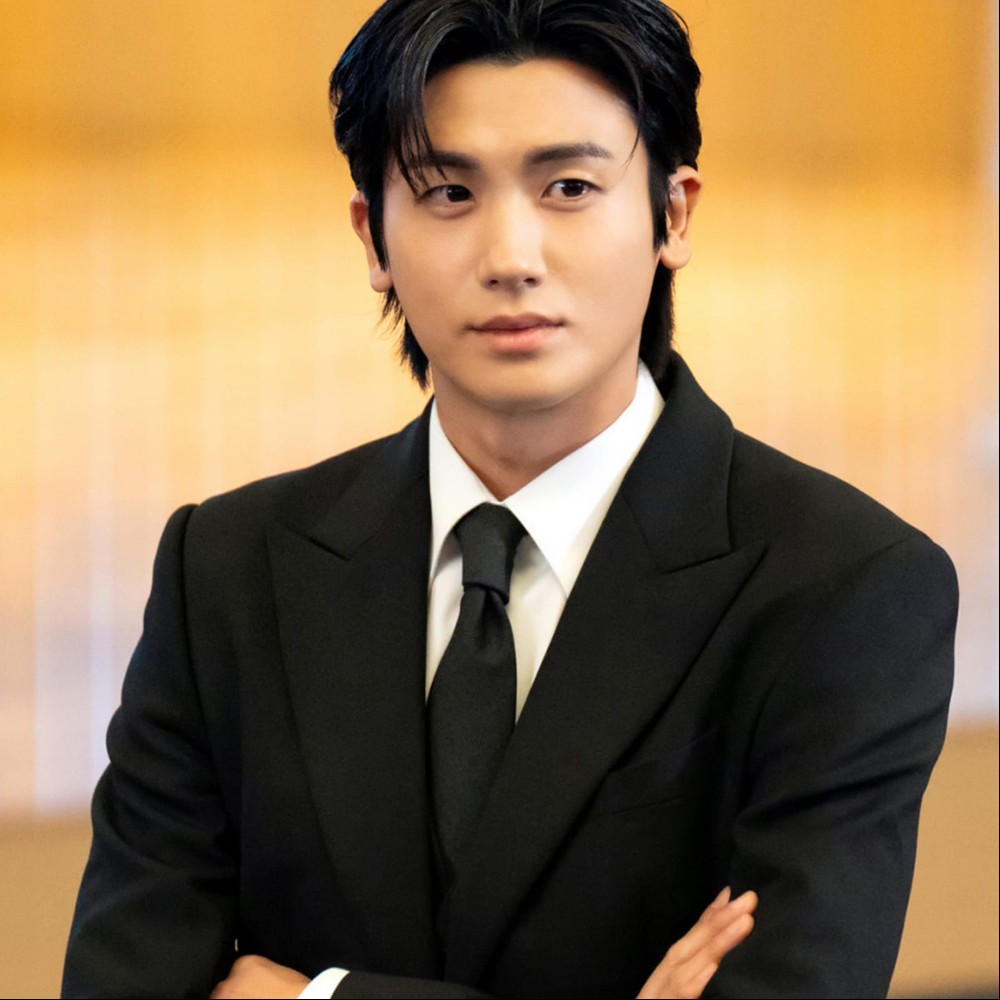

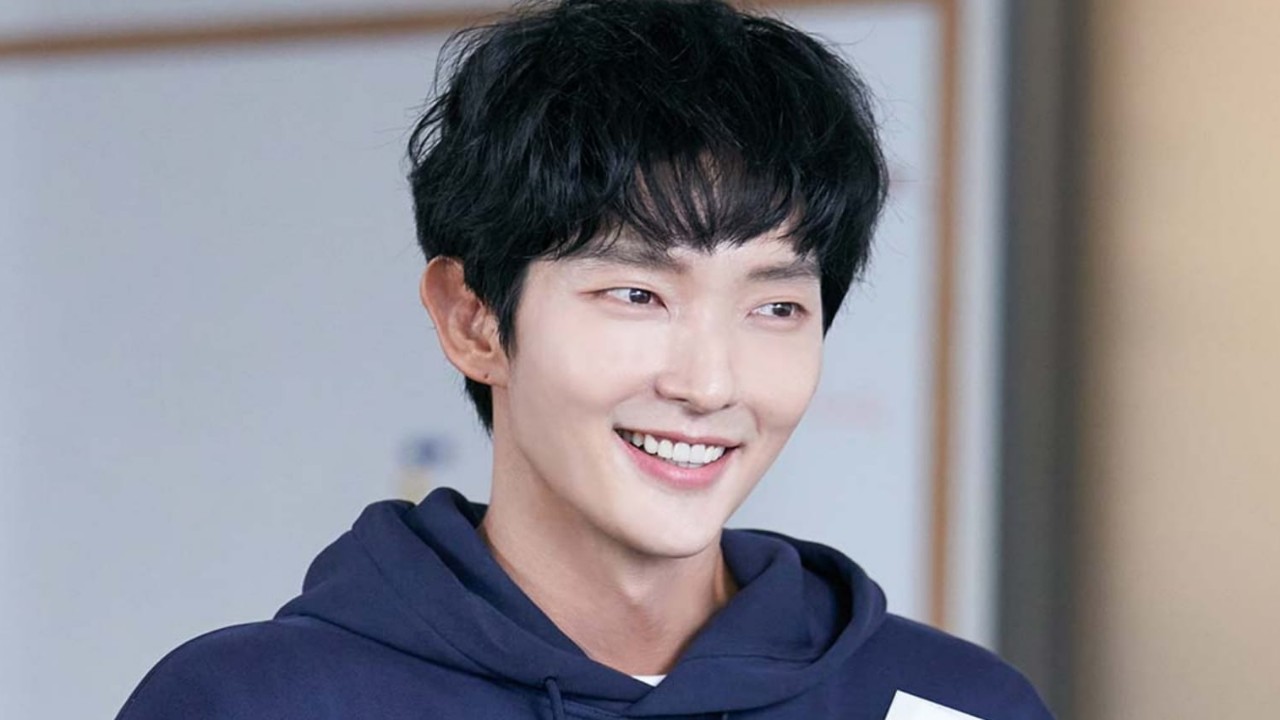

Lee Joon Gi's side breaks silence on 900 million KRW tax audit, defends one-man agency's financial practices

Lee Joon Gi’s agency clarifies his tax audit, saying the reassessment stemmed from differing interpretations of tax laws. The actor has paid the full amount and filed an appeal for review.

Namoo Actors, the agency representing actor Lee Joon Gi, has issued an official statement addressing reports about his tax investigation, aiming to clarify misinformation and provide transparency regarding the matter. The statement comes in response to growing speculation after it was revealed that the actor had undergone a tax audit, resulting in a significant reassessment of his financial obligations.

According to Namoo Actors, Lee Joon Gi was subjected to a standard tax audit by the Gangnam Tax Office in 2023 as part of the routine financial reviews conducted by the National Tax Service. Following the audit, tax authorities determined that additional taxes were owed due to differences in how Lee Joon Gi’s earnings had been classified.

As a result, he was required to pay an additional 900 million KRW (approximately 617,000 USD). His agency emphasized that this reassessment was not a result of tax evasion or deliberate misconduct but was instead caused by a discrepancy in the interpretation and application of tax laws between his financial team and the tax authorities. They also assured that Lee Joon Gi had complied with the reassessment order and had promptly settled the full amount requested.

The investigation primarily focused on JG Entertainment, a one-man agency that Lee Joon Gi founded in 2014 alongside his father to manage his professional earnings. Although the actor has been under an exclusive management contract with Namoo Actors for his entertainment career, his income was processed through JG Entertainment. This allowed his earnings to be taxed at the 24% corporate tax rate instead of the significantly higher 45% personal income tax rate.

Authorities raised concerns over whether this structure was intentionally designed to minimize his tax liabilities, leading to an in-depth examination of his financial transactions and tax filings.

Beyond the issue of income classification, the tax audit also included scrutiny over a luxury property in Cheongna, Incheon, which JG Entertainment purchased in 2021 for 2.95 billion KRW (approximately 2.02 million USD). Some reports speculated that the penthouse was being used as Lee Joon Gi’s private residence rather than serving a legitimate business purpose. However, his representatives strongly denied these allegations, asserting that the property was acquired through proper legal procedures.

After conducting a thorough review, tax authorities confirmed that there were no violations in the transaction, dismissing any suspicions regarding its ownership and use.

Namoo actors further explained that Lee Joon Gi’s financial management system had never been deemed problematic in past audits. They pointed out that there is no existing legal precedent prohibiting an entertainer from handling their income through a personal corporation. Despite fully complying with the reassessment decision, Lee Joon Gi has filed an appeal with the Tax Tribunal, requesting a formal review of the ruling. The agency stated that this request is currently under examination and that the actor is awaiting an official response from the authorities.

JOIN OUR WHATSAPP CHANNEL

JOIN OUR WHATSAPP CHANNEL