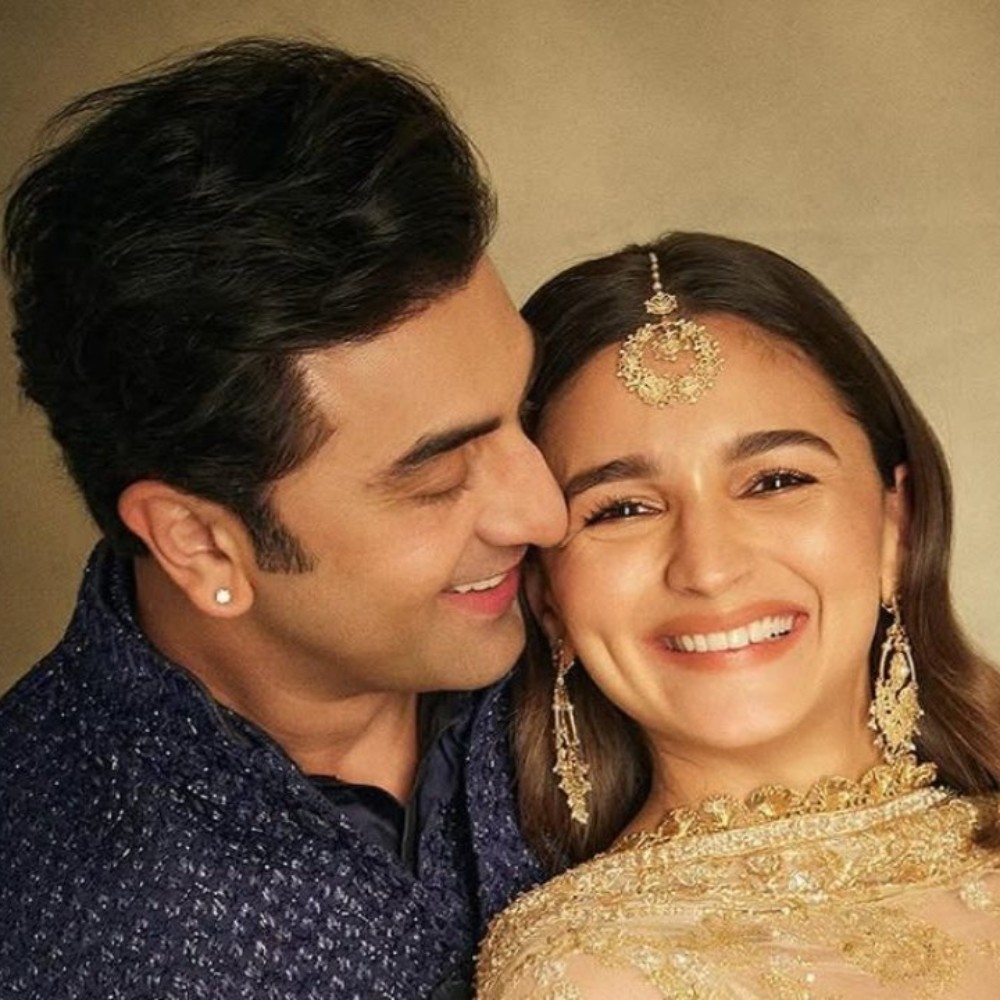

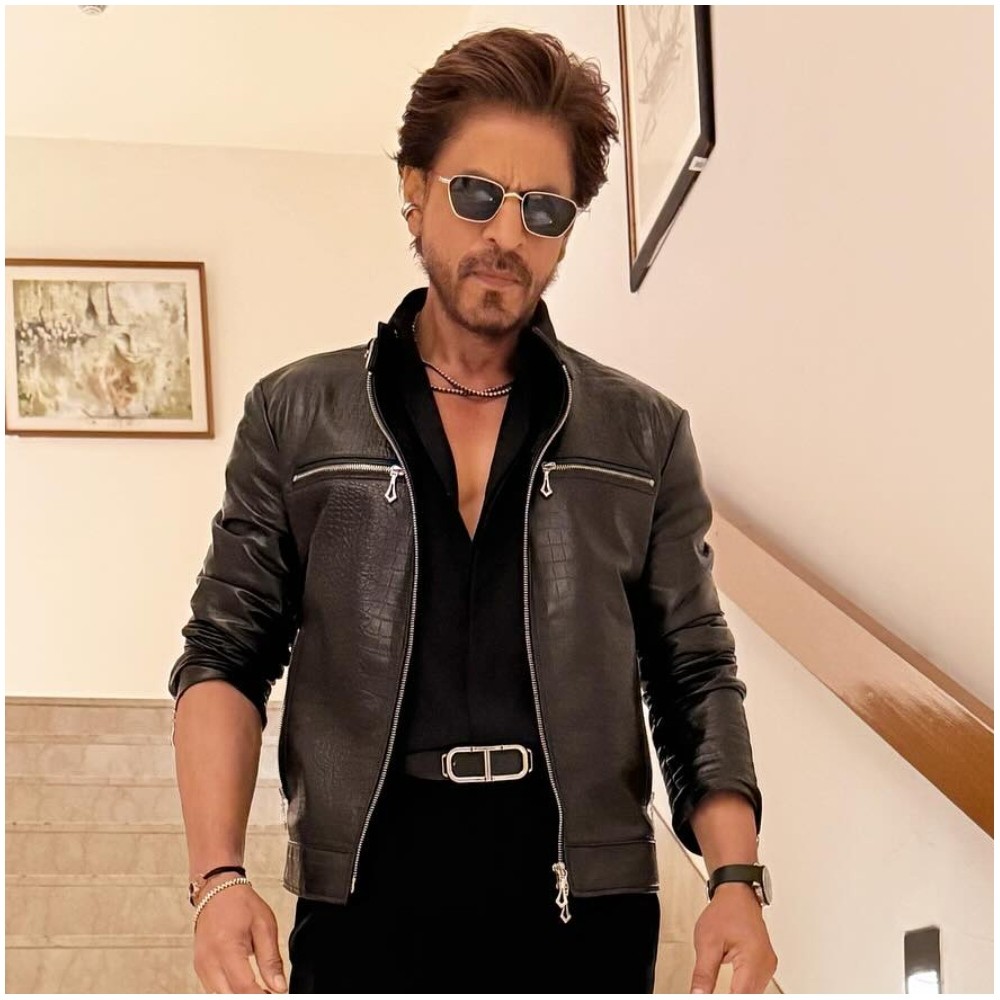

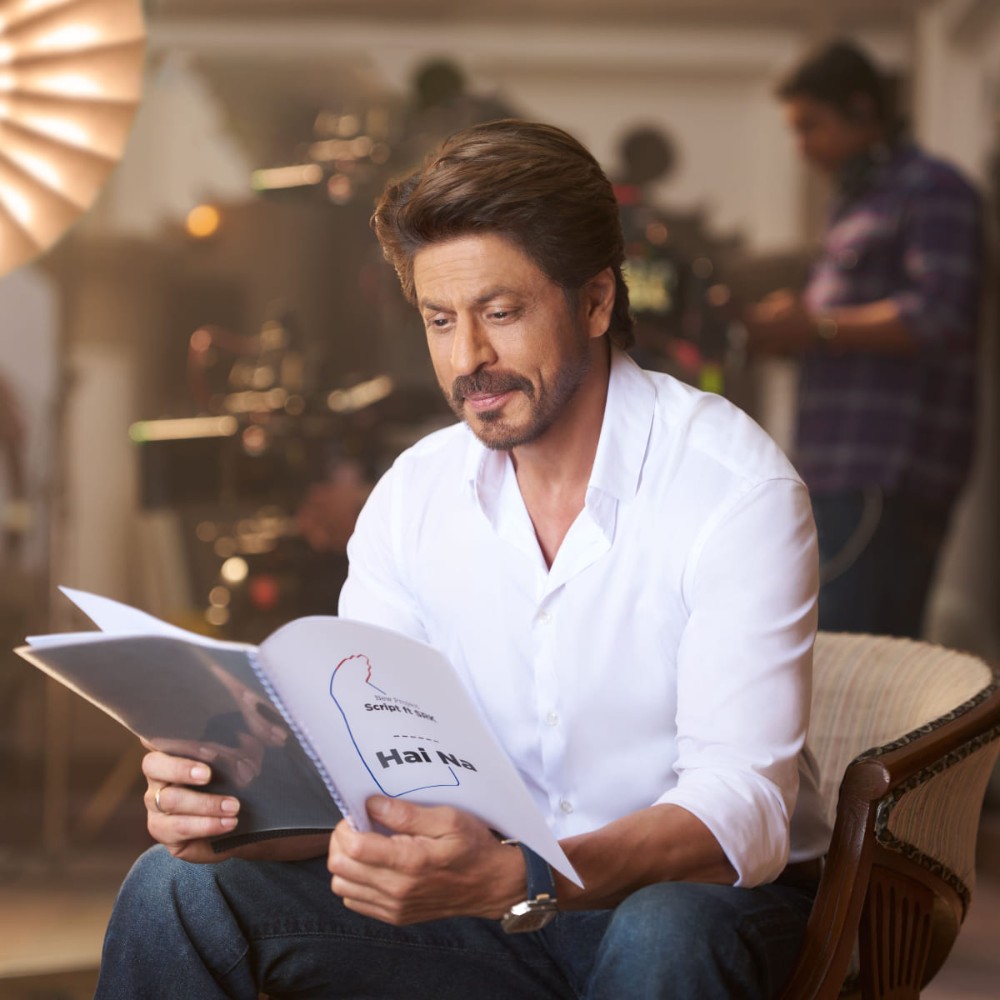

Shah Rukh Khan secures BIG victory in tax case; find out how

The ITAT bench ruled that the income tax department's reassessment of Shah Rukh Khan's case was not legally justified.

In a major win, actor Shah Rukh Khan has successfully resolved a tax dispute, with the Income Tax Appellate Tribunal (ITAT) ruling in his favor. The tribunal has dismissed the reassessment process and the order previously issued by tax authorities for the financial year 2011-2012. As reported by The Times of India, the ITAT has nullified the reassessment proceedings.

In a conflict regarding his income tax return, the tax officer challenged Shah Rukh Khan's reported earnings of Rs 83.42 crore, denying his request for a foreign tax credit on taxes paid in the UK.

As a result, the officer reassessed his income at a higher amount of Rs 84.17 crore. This reassessment took place more than four years after the conclusion of the relevant assessment year, which was 2012-13.

The ITAT bench ruled that the income tax department's reassessment of the case was not legally justified, marking a significant victory for Jawan actor in his prolonged dispute over foreign tax credit claims.

The case pertained to the taxation of the actor's earnings from the movie RA One, which was released in 2011.

As per the report, an agreement was in place between King actor and Red Chillies Entertainment, a film production and distribution company co-founded by the actor, specifying that 70% of the movie's shooting would take place in the UK.

As a result, 70% of the revenue was considered foreign income and subjected to UK taxation, including withholding tax. To implement this arrangement, the actor's payment was processed through Winford Production, a UK-based company. However, tax authorities argued that this payment structure led to a loss of revenue for India.

The ITAT bench, consisting of Sandeep Singh Karhail and Girish Agrawal, ruled that the reassessment proceedings were invalid. They pointed out that the assessing officer had failed to present any "fresh tangible material" justifying a reassessment beyond the statutory four-year period.

Additionally, the bench noted that the matter had already been reviewed during the initial scrutiny assessment. Based on these factors, it concluded that the reassessment proceedings were legally flawed on multiple grounds.

JOIN OUR WHATSAPP CHANNEL

JOIN OUR WHATSAPP CHANNEL